Talking about white-collar crimes, it is a non-violent crime committed for financial gains and often results in distress and loss to some other person. These are not victimless crimes rather it devastates families, destroys companies and leave the victim suffering and weeping. The term white-collar crimes are an umbrella term and includes – corporate fraud, money laundering, insider trading, embezzlement, etc. to name a few.

White collar crimes or crimes of the sophisticated segment of society, as I call them to have the following essentials;

- Non-violent in nature

- Act or omission resulting in injury

- Intention to defraud

- A wrongful loss to the victim and wrongful gain to the perpetrator

- Aimed at financial enrichment of perpetrator

- Results in financial distress to the victim

- Not dependent on the application of physical force /threat/violence

Brief Historical Background

The white-collar crimes have been linked to the sophisticated, educated and affluent people ever since it was first defined by sociologist Sir Edwin Sutherland, long back in 1939. He defined them as – “a crime committed by a person of respectability and high social status in the course of their occupation.” He mentioned that a wrongdoer is generally a person who is entrusted with a great amount of faith and trust, and perpetrators of this category were usually businessmen, politicians, high ranked officials, and many more. They are educated, intelligent, affluent, and confident opportunists whose jobs involve unmonitored access to the accumulation of large financial gains.

It is pertinent to note that with the advent of technology, these crimes have spread their roots even wider. They now include cybercrimes, frauds relating to healthcare apart from the traditional ones like bribery, perjury, anti-trust acts, tax violations and breach of trust.

Kinds of white-collar crimes

White collar crimes are so vast that they cannot be generalized and hence a deep understanding is required to detect and deter such crimes.

Sir Edwin Sutherland very rightly said that “One common misconception about the corporate crime is that its effects are mainly financial.” But for proper codification and assessment of such offenses it is necessary to understand that any act or the omission did with the intention to defraud and for avoiding financial loss or for gaining subsequent financial advantage are all crimes and when done by the sophisticated members of society become white-collar crimes. In a case involving Hooker Chemical Company, it was observed that when the alleged company, that was involved in the manufacture of chemical products, disposed them without proper treatment into the abandoned Love falls at Niagara and sold the adjoining land to a family for residential purpose without disclosing material facts of the land being polluted by discharge of chemical effluents which eventually led to miscarriages, birth defects and other major health issues to the occupants also fall under the ambit of white-collar crimes.

The omission on the part of the chemical company to treat the chemical effluents and proper disposal of harmful chemicals which led to such serious problems and posed a threat to life of others, is nothing less than white-collar crime. Negligence on the part of the firm, failure to file assessment reports and the intention to defraud the school board first and the family consecutively, all of this is liable to strict fines and punitive damages.

Classification of white -collar crimes

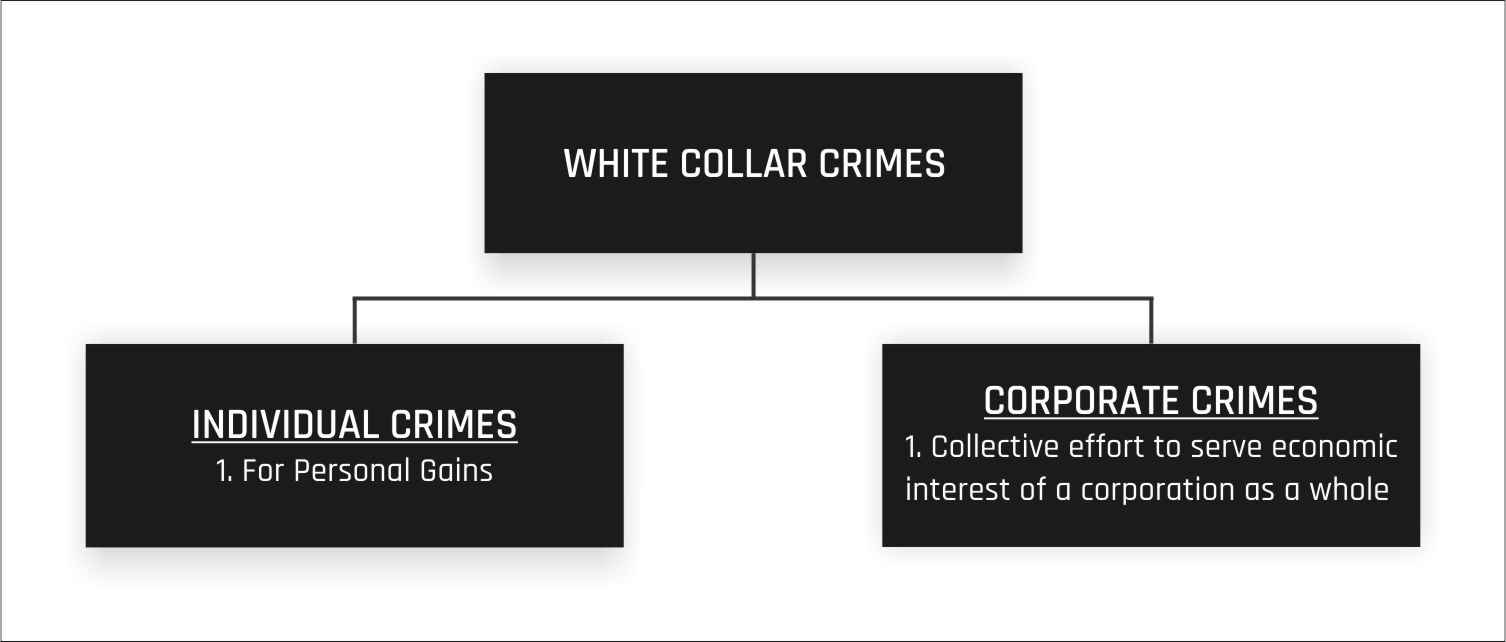

White collar crimes can be divided into two categories – individual crime and corporate crime. This classification is done on the basis of the nature of offender. Crimes done for personal gains or enrichment are called individual white-collar crime, and those done as a part of a collective and organized effort to serve the economic interests of a body corporate or a firm and are called as corporate crime.

Causes for White Collar Crimes

The basic motive behind such acts is greed or financial enrichment or economic instability. Following are certain reasons behind ever-increasing cases of white-collar crimes:

- Lack of awareness – White-collar crimes are different from traditional crimes in its approach and hence the victims often fail to understand it and are easily fooled at the hands of such perpetrators.

- Greed – It is aptly said that ‘there is ample for a man’s need but never enough for a man’s greed.’ The ever increasing wants of man are other driving forces behind the commission of such offenses.

- Not really a crime – The perpetrators or offenders often convince themselves that these acts are not actually crimes since they do not involve violent streaks that characterize traditional crimes.

- Necessity – Not always but sometimes such offenses are driven necessity as a resort to overcome financial hurdles in supporting their families.

- The satisfaction of one’s ego – The offenders often commit such acts to satisfy their ego and impulse.

- Lack of proper implementation of laws in this regard – Inability to execute existing laws in a strict manner often result in rise of such acts.

White Collar Crimes – A Detailed Study

There are several ways in which the white-collar crimes are executed, they range from petty amounts to sometimes sky-rocketing amounts. A detailed analysis of these ways have been done below:

- Bank fraud – Acts committed or omitted to defraud a banking institution.

- Bribery- Acts committed with intention to create undue influence over a party holding some eminent position or in order to accelerate and conceal certain acts with an intention to defraud others.

- Black marketing- Acts involving the sale of illegal things or selling legal things in an illegal way, for minting money.

- Corporate fraud – Acts done by corporate entities which involve accounting schemes that are conceived to deceive investors, auditors, and analysts about the true financial condition of a corporation or business entity.

- Insider trading- Acts that involves trading in a public company’s stock by someone who has non-public, material information about that stock for any reason.

- Money laundering- Acts of minting large amounts of money generated by criminal activity, such as terrorist funding or trafficking and making them appear to have come from a legitimate source.

- Mortgage fraud- Deliberate misrepresentation and deception involving lending practices that target certain borrowers.

- Pump and dump schemes- The fraudulent the practice of encouraging investors to buy shares in a company in order to inflate the price artificially, and then selling one’s own shares while the price is high.

- Self -dealing – Refers to the conduct of a trustee, attorney, corporate officer, or other fiduciaries that consists of taking advantage of their position in a transaction and acting for their own benefit rather than in the interests of the beneficiaries of the trust, or their clients.

- Wire fraud- A crime in which a person plots a scheme to defraud or obtain money based on false representation or promises. This criminal act is achieved using analog or digital electronic communications techniques. Also, known as cybercrime by some people.

There are several other crimes that fall under this category. In this article, a detailed analysis has been done on the most common types of white-collar crimes, i.e. Insider trading and Wire fraud.

Insider trading

Insider trading is the practice of exchange of a security by someone who has access to material non-public information about the security or vital functioning of a corporate entity. Insider trading can be illegal or legal depending on the time when the event or transaction was made by the insider. It is offensive to indulge in such activities when the material information is still not released in the public domain. When insiders, e.g. prime employees or executives or top-level management, who have access to the strategic and sensitive information about the corporate entity, use the same for trading in the company’s stocks or securities, it is known as insider trading and is highly condemned by the Securities and Exchange Board of India hereinafter referred to as SEBI. The sensitive information talked about in the definition of insider trading is that information whi1ch relates to private and confidential affairs of the company and have been kept as a secret for some reason, unknown to lower level management.

In order to promote fair trading in the market for the benefit of the common investor, the SEBI comes up with measures that curtail corrupt practices and promote fairness in the security market. These insiders may include-

(a) Persons who are related to the company;

(b) Persons who were in some manner related to the company and have access to such information;

(c) Persons who are deemed to be a part of the company.

Role of SEBI in curbing the Insider Trading

The SEBI (Securities Exchange Board of India) is the regulating body that frames and amends laws relating to unfair practices in security markets. The SEBI makes sure that the participants have access to all relevant information, simultaneously ensuring that no sensitive information is leaked in the name of it. The enforcement of insider trading laws enhances market liquidity and decreases the cost of equity and makes it easier for the investors to operate. The penalties for committing corrupt acts like insider trading have been defined under Chapter IV-A of the SEBI Act. The penalties have been discussed in the SEBI (Amendment) Act, 2002.

Case laws

The instance of insider trading has its existence dating back to the era, even before the establishment of SEBI, 1992. Famous case law is the TISCO Case, 1992. In this case, the net profit of the TISCO for the first half of the financial year 1992-93 was seen as to Rs. 50.22 crore as compared to the profit of Rs. 278.16 crore for the previous financial year i.e. 1991-92. Prior to the announcement of the half-yearly results relating to profits of the company, there was tremendous activity in the trading of share from October 22, 1992, to October 29, 1992. However, the Sensex saw a decline of 8.3% during the same period. The insiders who had the insight of the same had drastically manipulated the market to make some marginal sales. Small investors were badly affected. Due to the absence of any legal framework relating to insider trading in India, it was not possible to investigate the case at that time.

Wire Fraud

Wire fraud is a crime in which a person formulates a scheme to defraud or to wrongfully gain a financial advantage based on false representation or promises. These offenses take place through electronic media like calls, messages, e-mails, etc. A person does not necessarily have to actually defraud someone or personally send a fraudulent message to be charged with wire fraud. Having knowledge of an act of wire fraud, and not acting in contravention to the same, is more than sufficient to establish the intention. The common ways of executing such offenses include wooing the prey with tales of love or riches or by convincing the potential victim by means of fake phone calls, messages, or links. The IT Act 2000, deals with such crimes. However, there have been no direct laws with regard to the same.

Laws regulating White-Collar Crimes

In India, several legislations have been passed in this regard. To name a few, the Essential Commodities Act 1955, the Industrial (Development and Regulation) Act, 1951; the Import and Exports (Control) Act, 1947; the Foreign Exchange (Regulation) Act, 1973; Companies Act, 2013; Prevention of Money Laundering Act, 2002; the Indian Penal Code,1860; the Information and Technology act, 2000. Not just the government but the Reserve Bank of India has been consistently working to eradicate the white-collar crimes (banking frauds, insurance frauds) from society. The KYC (Know Your Customer) initiative by the RBI has been a path-breaking development in regards to deterring white-collar crimes. The SEBI (Securities Exchange Board of India) has also played a major role in curtailing such offenses. It has laid strict rules and regulations with regards to white -collar crimes and has imposed strict and heavy penalties on such wrongdoers.

The SCRA (Securities Contract and Regulation Act) has also made several important contributions in making the markets safer and protecting the rights of investors.

Indian Case Laws

1. Harshad Mehta Securities

The story of white-collar crimes in India started long ago in 1988 and has been on a significant rise since then. The Harshad Mehta’s case is a perfect example to understand the “pump-and-dump” scheme under white-collar crimes. He was known as the ‘Sultan of the Dalal Street’, he manipulated and misappropriated the stock prices of certain scrips for his gain. As a result, there was unnatural pumping of money in the stock markets causing a drastic and sudden rise in the price of these shares or securities. When this scam was exposed, the market went down by ₹ 0.1 million per day. This was the biggest crash the stock market had ever experienced. The SEBI passed guidelines to regulate such conduct in the future.

2. Punjab National Bank Fraud or the Nirav Modi Case

The accused (Nirav Modi) is a diamantaire and an elite jewelry designer. It is said that Nirav Modi and the corporate entities linked to him greatly colluded with its officials to get Guarantees or Letter of Undertaking (LOU) to help fund buyer’s credit from other overseas or international banks/ financial institutions.

After making necessary investigation in the case, it was found that two officials of the bank had fraudulently issued LOUs to the said firms without following the due procedure. These Lou’s were then transferred across the SWIFT messaging system, relying on which the credit was offered to the said companies. PNB had already issued the stock exchange a report of the fraud and had gone through a $1.8 billion fraud, one of the biggest corrupt acts of such kind to be detected in the Indian Banking Sector, to date.

Conclusion

The term white-collar crime has not been expressly defined under any code but includes various serious offenses. With technological development, these crimes have increased beyond realization. Looking at the present scenario, there is a need for stringent and strict laws that aims at eradicating such crimes from society and tries to restore fairness, equity, and justice. The traditional laws need to undergo drastic changes to accommodate such crimes, penalize them, and deter their occurrence. The Indian Penal Code, 1860 along with special laws formulated to combat such crimes must be worked upon. Also, this improvement can come with an increase in transparency, accountability, and awareness. White-collar crimes can be treated by developing constructive harmony among existing laws and by formulating new ones that exclusively deal with them. Setting up special courts would lead to speedy justice and the smooth functioning of society.

References

- United States v. Hooker Chemicals & Plastics Corp., 850 F. Supp. 993 (W.D.N.Y. 1994)

- KYC initiative by the R.B.I.

- Harshad s. Mehta & Ors. vs the state of Maharashtra; appeal (Crl.) 319-320 of 1996

- Punjab National Bank v. M/s Stellar Diamonds (OA no.119/2018)

(This Article has been written and submitted by Ms. Mansi Batra during her course of internship at B&B Associates LLP. Ms. Mansi is a third-year law student at the Fairfield Institute of Management and Technology, Kapashera, New Delhi.)