– This article is about infrastructure laws on Naval Ports and Airports. For Roads and Power; Railways, Telecom and Oil & Natural Gas and Renewable Energy, you may refer to part II and Part III. For further clarity on any point, you may write to our top lawyers for infrastructure laws in Chandigarh.

Introduction of Infrastructure Laws in India

The infrastructure and developmental projects hold a strong footing towards the economic growth of India. The consistent infrastructure growth attracts the big investors from among India and foreign countries which in turn paves a way for the open market economy. There has been a gradual departure from the controlled market towards the open market, wherein, the Foreign Direct Investment (FDI) is encouraged. This also calls for the governance to avoid a breach of the infrastructure laws in India and the regulations.

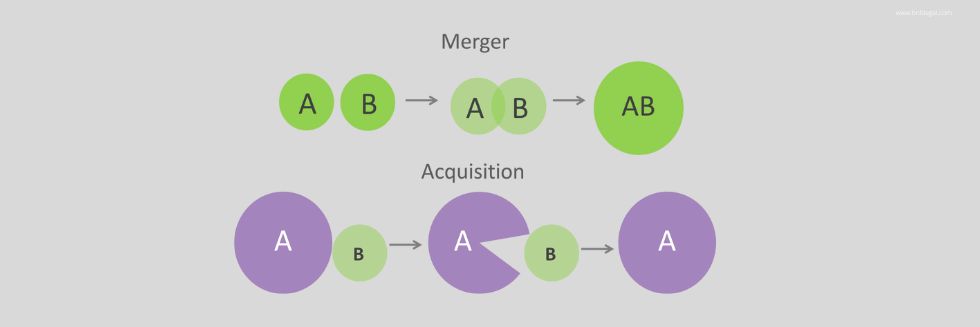

The infrastructure sector consists of various sectors. Each sector has its own governing Statue and as such does not bear any harmonisation with the regulations pertaining to other sectors. Under these Statutes, the private developers are provided with the modes and means to participate by granting them the licenses. In some cases, the contractual relationship between the private developer and the government is established for the development of a particular infrastructure project.

Although the Centre and State governments have separation of powers to govern their projects, in some sectors the joint governance is required. A clear study of the regulations and the policies governing different sectors direct towards their impromptu nature. The legal framework pertaining to different sectors is illustrated in separate parts of this article.

Infrastructure Laws on Naval Ports:

The ports serve as a gateway of international trade through the sea and require the development for a smooth running of its operations and activities. The Central and State governments have taken the route of competitive bidding to encourage private sector investment. The Government of India (GOI) while recognizing the high expenditure involved in rather time taking a process of development of ports has made an effort to form public-private-partnerships (PPPs) by encouraging funding schemes which are flexible enough. Major Ports Trusts Act, 1963 as amended time is the governing Act for the ports. Up to 100%, FDI is allowed. Furthermore, 30% rebate on the earning can be availed after the period of Tax holiday of 5 years. This facility is available within the first 12 years of the assignment of the Project. The GOI is also focusing on developing the National Maritime Development Policy to expedite and enhance the private sector investment and stimulate competitiveness for attaining better service quality.

Infrastructure Laws on Airports:

Earlier the GOI was responsible for development and operations of the airports. The Airports are governed by the Aircraft Act, 1934, and the Aircraft Rules, 1937. Thereafter in 1994, the Airports Authority of India Act was enacted, wherein, this power to develop and operate was transferred to the Airports Authority of India. The said Act was amended in 2003, thereby, facilitating the investments of the private sector. Under the governing legislation, the license is issued to the private developer for the development and operations of the concerned Airport.

The Greenfield Airports projects allow the private sector participation and do not require the prior approval from the Government. The private developer also enters into a Joint venture with the Airports Authority of India. An FDI of 100% is allowed under the automatic route in case of the Greenfield Airports projects.

Any Airport project other than Greenfield Airport project, as run by the private developer, requires the approval of the Director General of Civil Aviation (DGCA). Under PPP route, the Airports are developed on the basis of concession Agreements or as per the Build-Own-Operate-Transfer (BOOT), Build-Own-Transfer (BOT) or Build-Own-Operate (BOO) contracts. In these projects, the approval of the Foreign Investment Promotion Board (FIPB) is required in cases where the proposed Investment is more than 74%. The Foreign Airport Authorities may also participate through equities. The tax exemption of 100% is granted for the period of 10 years.

Conclusion:

Thus, the GOI has taken steady steps towards encouraging private investment and participation. The private sector developer is required to meet the criteria as set by the public body in the tender document. Both the Naval Ports and Airports have separate regulations which in turn reduces the risk of the conflict of interest between the central and the state development units.

For more insights and information regarding the above-mentioned sectors, you may contact our expert infrastructure lawyers.