Introduction

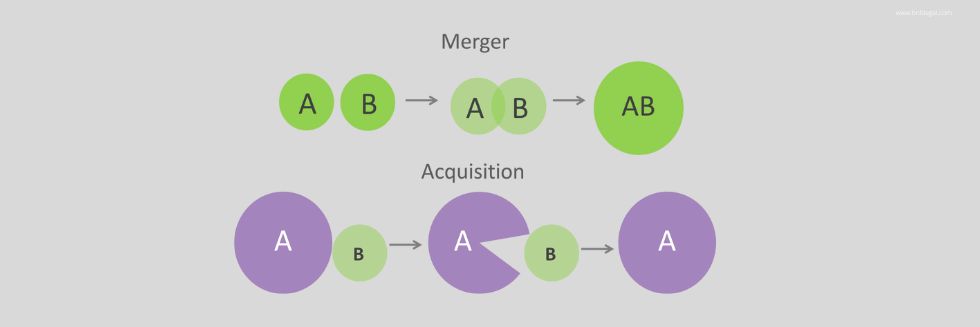

With the liberalization of the Indian economy, globalization, and the need for consolidation and diversification, mergers and acquisitions activity has seen a surge in recent years. However, carrying out mergers, acquisitions, and combinations involves complex legal requirements that must be understood to guarantee a successful transaction.

Numerous legal issues must be handled by a business from the first point of contact with a target until the deal is finalized. In order to prevent the existential danger of litigation, it is crucial for a firm to hire a qualified and experienced Mergers and Acquisitions Lawyer before embarking on its mergers and acquisitions journey.

Key Legal Aspects of Mergers and Acquisitions

1. Due Diligence

Due Diligence is top of every corporate Merger and acquisitions attorney’s to-do list. Covering all aspects of the target company, from its operations through to its intellectual property.

The acquiring company should conduct a comprehensive review of the target company’s financial statements, contracts, legal documents, and operational procedures to identify any potential risks or liabilities.

Due diligence is often where outstanding legal teams differentiate themselves from the rest, adding significant value to the transaction with their attention to detail and ability to identify important details amidst typically huge piles of information and of course, to flag issues that could lead to litigation.

2. Deal Structure

People frequently associate the phrase “deal structure” with financial arrangements, earn-outs, and distinctions between cash and stock. The truth is that a transaction structure involves legal as well as financial considerations.

Corporate Mergers and Acquisition attorneys will also provide advice on whether to purchase the entire company or just its assets.

3. Representations & Warranties

The use of a representation and Warranty clause in relation to transactions is now common practice for acquirers.

These typically aim to avoid the threat of litigation for the acquiring firm in issues such as Compliance, Tax, Authority, Capitalization, Material contracts.

Violations of any of these terms and conditions can lead to an indemnification claim from the acquirer, eroding the value of the transaction.

4. Non-Compete and Non-Solicit

These are important legal clauses in practically all transactions, particularly in the service industries.

Let’s say a tech company buys a tech startup with the best software engineers in Silicon Valley. What’s stopping the team members from jumping ship and starting a new company right after selling their startup?

Restrictions here should be reasonable in their time and scope and include some consideration.

5. Target indemnification

Target indemnification are hotly contested clause in the closing conditions of Mergers and Acquisition transactions.

Again, these are essential clauses that seek to protect the acquiring company on the downside.

6. Joint and Several Liability

Joint or several liability is an extension of the target indemnification issues.

In the case of joint liability, each of the target’s shareholders is fully liable for any future damages.

In the case of several liability, each of the target’s shareholders can be liable only to the extent that they are seen to have contributed to the damages.

7. Closing Conditions

The conditions set out in the definitive agreement are themselves subject to closing conditions. As the name suggests, there are conditions that must be met in order for the transaction to close.

Consequences of Non-Compliance

Non-compliance with the legal requirements for such transactions can lead to various consequences, including:

1. Imposition of penalties

Non-compliance with the legal requirements can result in penalties being imposed by the competition authorities. The CCI has the power to impose a penalty of upto 1% of the total turnover or assets of the company, whichever is higher, for non-compliance with the provisions of the Competition Act.

2. Rejection of the merger/acquisition

Non-compliance with the legal requirements can lead to the rejection of mergers or acquisitions by the regulatory authorities.

3. Legal action

Non-compliance with the legal requirements can also result in legal action being taken against the companies involved. The Companies Act provides for legal action against the company and its offices for non-compliance with the provisions of the Companies Act.

4. Damage to reputation

Non-compliance with the legal requirements can lead to damage to the reputation of the companies involved. This can have a negative impact on their brand image and customer loyalty.

5. Delay in the transaction

Non-compliance with the legal requirements can result in a delay in the completion of the transaction. This can lead to increased costs and uncertainty for the companies involved.

Conclusion

M&A are governed by a complicated set of laws in India. As a result, it is important for the parties involved in these transactions to take legal advice and follow the applicable laws and regulations. This will help the parties to avoid the consequences of not following the rules and regulations and ensure a smooth and successful transaction.

This article is written and submitted by Advocate Sahil Nayyar and you can reach out to the author at sahil@bnblegal.com.