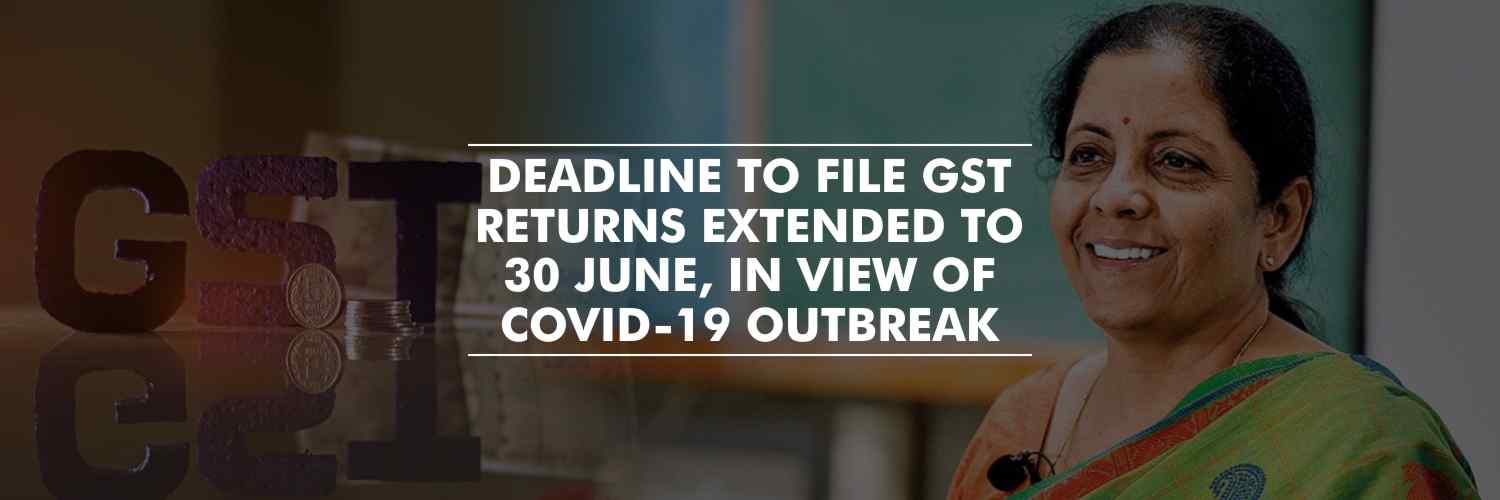

In view of the outrageous spread of pandemic disease (COVID-19), Union Finance Minister Nirmala Sitharaman has today extended the last date to file Income Tax and Goods and Services (GST) returns and Aadhaar-PAN linkage for the purpose of filing IT returns, to 30 June.

The interest rate charged on delayed deposits of Tax deduction at Source has also been lowered from 12% to 9%. Further, in a relief for small businesses and companies with a turnover of Rs 5 crore or less, they will not require to pay a late fee or penalty for failing to file GST returns on time.

Finance Minister Sitharaman addressed the media regarding a decision to raise the threshold of default under section 4 of the Insolvency and Bankruptcy Code 2016, to Rs 1 crore (from the existing threshold of Rs 1 lakh), which will help prevent triggering of insolvency proceedings against Ministry of Micro, Small and Medium Enterprises.

Initially, the GST annual returns of Financial Year 2018-19, was 31 March 2020, which has now been extended till the last week of June 2020, as a measure to tackle the economic impact of coronavirus. Sitharaman has also announced the suspension of Sections 7, 9 and 10 of the Insolvency and Bankruptcy Code (IBC) for six months, if the current situation continues beyond the 30th of April 2020.

Such relaxations have also been implied to the banking sector with an exemption of incurring transaction fee to the debit cardholders, for the next three months. Also, the fee to be paid for not maintaining minimum balance in accounts has been waived and has reduced bank charges for digital trade transactions for all trade finance consumers.